At the risk of sounding like a broken record (or your parents 😉 ), I want to remind you one important thing that you absolutely must have every time you’re going overseas:

Travel Insurance

Look, I’m not trying to ‘nag’ but I’m sure you’ve heard this one before

If you can’t afford travel insurance, you can’t afford to travel!

While this may sound like some cheesy advertising slogan, let me tell you that this one is for real!

This is based both on my own experience as well as that of many other people I’ve come across in my travels.

For just a small sample of the multitude of things that can go wrong while you’re traveling outside Australia, check these two short videos from the federal government.

Sure, they are both ads but honestly, don’t you agree they both describe very realistic scenarios?

Do you suffer from ‘Ad blindness’ and can’t take seriously anything said in an ad, no matter what it is and by whom?

Hey, I get it. As a matter of fact I myself am pretty much blind as a bat when it comes to ads! 😉

Instead, here are two real serious mishaps that occurred to large groups of Aussie tourists while overseas and in which travel insurance could have saved them (at least to some extent) from being significantly out of pocket.

- People went to Bali. A volcano erupted. Flights got cancelled and people got stranded there for days having to fork out more money for accommodation and other ancillary expenses.

- People went to Hawaii. The Airline that flew them there and was supposed to bring them back home went bankrupt without any advance warning. You can imagine what happened next yourself.

- If you want a more recent example, this UK airline collapsed just yesterday without any prior warning. As a matter of fact, they were still running promos and sales to various destinations the day before!

Do you have any doubt that similar incidents can (and will!) happen again in the future, often with zero prior warning?

Unless you already have travel insurance provided for you (like through your employer or credit card for example) and you’ve made sure it covers you for the activities you plan to undertake overseas (keeping in mind that many insurance companies consider even something like hiking or bushwalking to be ‘adventure sport’), getting this item sorted before you go anywhere is really as important as having a Passport!

Saying that however, I won’t deny that travel insurance (like most other insurance products) is one of those products that falls into the ‘grudge purchases’ category.

Basically, you buy it because you have to and are paying for peace of mind.

You know full well that, if everything goes according to plan, you actually will never use this product.

This makes it even more important to make sure you get the absolute best deal on your travel insurance.

Like with other insurance products (or any kind of product for that matter!), the best deal does not necessarily mean the absolute lowest price in dollar terms.

Instead, it means the lowest price possible on a product which meets your needs!

After all, what’s the point of buying a policy for a rock bottom price only to find out later on that it won’t actually cover you for the activities & places you plan to visit.

That would literally be like flushing your money down the toilet! You might as well not buy a policy at all if all you want is just a cheap price and all else be damned.

Before we get cracking, I thought I’d include this clip from the ABC’s outstanding (and hilarious!) consumer affairs show The Checkout to set the scene.

Nice ey? These people are absolute legends!

They managed to create a comedy show out of consumer affairs stories while also genuinely helping Aussies get more savvy.

It’s such a shame the powers that be at the ABC decided to can it! 🙁

(P.S: I had the great privilege to interview one of The Checkout crew who did one of the funniest regular segments in the show’s first couple of seasons, the ‘guilty mum‘).

Alright, now that we’re done with the jokes, it’s time to get serious.

What you need to know about buying travel insurance:

1. Educate Yourself

Travel insurance is different to other forms of protection and even other insurance products.

Keep these points in mind to help you save money when shopping for coverage:

- Policies Differ – Read policies prior to purchasing, making sure that you fully understand what is covered and how claims are resolved. Check for unnecessary coverages, and do not spend on insurance that covers things that you do not need.

- Purchase in Advance – Travel insurance purchased well in advance of the trip will give you time to research and read policies. Think of travel insurance like car insurance – you don’t know how valuable it is until you need it. If you purchase well ahead of your travel plans, you can avoid unpleasant surprises.

- Documentation – Like other forms of insurance, policy issuers are a suspicious lot and will be cautious of fraudulent claims. For example: your travel insurance company may require evidence of delays or official reports to file an insurance claim. When you travel, get everything in writing, and keep it in a safe place. Ideally, I would also recommend you take photos of important documents with your smartphone and keep a copy in the cloud. You can use the outstanding Google Photos service for that which offers unlimited photo storage free of charge as well as excellent search functionality for all your images.

2. Trip Cancellation Policies – Read the Fine Print

One of the more common concerns for travellers is cancelled trips.

This includes cancelled flights, tour packages, car rentals, or prepaid entertainment packages (e.g a Broadway show or that Hawaiian Lu’au you’ve booked for the whole family).

If a flight is cancelled for example, it can have a domino effect on the rest of the trip as you can’t go on a tour or cruise or pick up your rental car if you’re not at your destination on time.

Travel insurance can act as a buffer in cases of unexpected cancellations. Clauses in some travel insurance policies also provide protection for flight arrangement errors due to the fault of the airline, or due to circumstances that you do not have control over.

These include:

- You or your travel partner getting sick during the trip;

- Hurricanes, Earthquakes, Volcanic eruptions and other natural disasters;

- Terrorist alerts in your destination; and

- Lost or stolen luggage.

Read the fine print of your policy and make sure that you’re not paying for coverage that is already provided by the airline, hotel, or entertainment package provider.

After all, it’ll be silly to pay for the same thing twice, right?

3. Lost and Delayed Baggage Coverage – Read the Fine Print

Lost and delayed baggage is a common problem when travelling, and reading the fine print on your travel insurance policy (however boring this may be!) can save you hundreds of dollars in cases of a claim.

While some airlines automatically provide lost baggage coverage, do they provide baggage delay coverage?

If not, who is going to pay for your new clothes and toiletries or change of clothes until your delayed bags finally show up?

4. Don’t overdo it!

Check all your other existing policies and don’t insure for something that is already covered elsewhere.

This can be things like damage or theft of items your bought with a ‘premium’ credit card which has purchase protection insurance for anything bought with the card. Just keep in mind that often this cover lasts only for a few months after buying the item and that period can sometimes be even as short as 10 days after purchase.

5. Research the provider’s claims & customer service processes

Before you buy, assess the quality of an insurance provider in terms of its customer service team and claims process.

If you purchase travel insurance from a provider that isn’t accommodating when the brown stuff hits the fan while you’re overseas, then you’ve obviously wasted your money!

Remember that travel insurance is not a one-size-fits-all product so like with an electricity or mobile plan, there is no such thing as one overall best product.

It will depend on what your personal circumstances are like:

- Where do you plan on going?

- What do you plan to do once you get there? and

- How old are you?

6. Don’t buy travel insurance from your airline (ever)!

When you purchase your plane ticket directly from the airline, you will almost always be presented with an option to also add travel insurance. Quite often, it will be as easy as ticking a single box.

DON’T DO IT!

If you do, you are guaranteed to pay too much!

Analysis by financial comparison site Mozo has revealed the following disturbing findings:

- Airline and travel booking sites charge families up to 205% more for travel insurance than if they bought directly from the insurance company; and

- Couples in their twenties pay as much as 118% more for travel insurance when they purchase via airline and booking sites.

Mozo reached these figures using the following methodology:

Quotes were obtained for two different traveller scenarios in October 2017 using the Mozo insurance comparison tool and via the websites of airlines and booking sites.

The policies compared all had the following features:

- Excess of $100;

- Unlimited medical cover; and

- Minimum level of personal effects and cancellation cover appropriate to each scenario. However, some of the policies compared offer more than the minimum level of cover specified.

This final tip is actually the easiest one to implement: when an airline’s website or phone booking agent asks you if you would like to include travel insurance with your purchase for a “small additional fee”, just say “no thanks”. No exceptions! Easy 🙂

Suggested Travel Insurance providers to check out

If you plan to do ‘adventurous’ stuff while overseas (provided it’s legal obviously… 😉 ):

You should look into the “Adventure Sports Travel Insurance” plan from CoverMore.

Not only does it provide cover for things like Bungee jumping, Snorkelling & Scuba Diving, Caving and Abseiling but it’ll even cover more obscure activities you might undertake overseas like Dog Sledding or even Fencing.

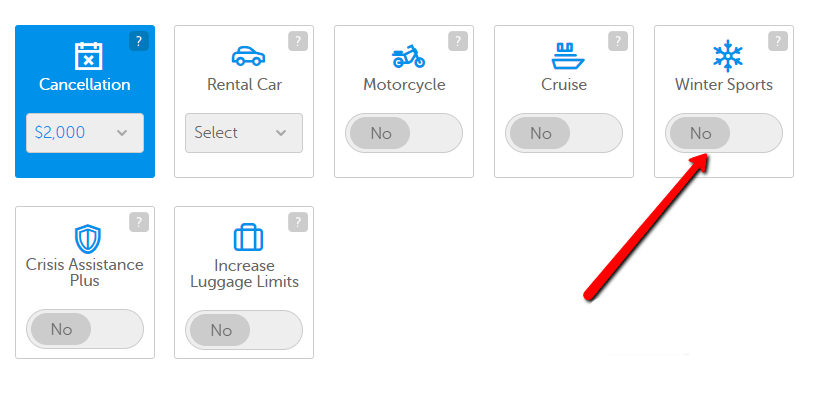

One important thing this plan does not cover though is skiing, snowboarding or any other winter sports.

If you’re off on a skiing holiday you will need to purchase the winter sports add-on in order to be covered.

Alternatively, if skiing or snowboarding are the only ‘adventurous’ activities you will be doing while overseas, you may want to consider buying:

A travel insurance policy specifically designed for people hitting the slopes.

If that’s the case for you then this policy is a very good option indeed.

It’s designed specifically for skiers and snowboarders and is the official travel insurance partner of Ski & Snowboard Australia who are the dedicated sporting association for competitive winter sports in Australia.

Other than covering amateur skiers and snowboarders, this provider is also the only insurer which covers professional skiers and snowboarders when they compete overseas.

If you’re over 60 years old:

Many travel insurance companies will either place a long list of exclusions and restrictions on your policy or refuse to insure you outright.

Therefore, it might be a good idea to consider a travel insurance product designed to cater specifically for travellers who are over 60.

Two good options to consider are:

- Seniors travel insurance from this provider (which was already mentioned previously); or

- This mob which was rated very highly by Choice (who are an impartial and completely independent adjudicator) and which offers a special product aimed specifically at older Australians.

For everyone else:

If you don’t plan to do anything other than sitting in bus, plane operated by a commercial airline, train or car (including a rental car), walking around the streets, visiting tourist attractions and sampling the local cuisine, then you should be OK with a ‘plain vanilla’ travel insurance plan.

Two such plans worth checking out are Columbus Direct & 1 Cover.

Columbus Direct is rated quite highly by their past customers and so does 1 Cover who rates very highly amongst past customers who have made a claim.

Personally, I found 1Cover’s pricing to be the most competitive every time I was checking prices for myself and have bought travel insurance from them on several occasions.

However, I’ve never made a claim with them so don’t have any personal experience with that side of their business (which is probably the one which matters the most! 😉 ).

Before I wrap this up, I want to remind you that any recommendations made in this post do not take into account your personal situation and particular needs and should not be considered as financial advice (either general or specific in nature) because we simply can’t give you any! see the disclaimer at the bottom of this page to understand why.

Do your own research and make sure to carefully read the PDS (Product Disclosure Statement) of the travel insurance product you decide to take (whether it is from one of the providers mentioned here or not).

The Federal Government’s Smart Traveller website has a great travel insurance buying guide outlining what to look for and what are the potential pitfalls.

Happy travels! 🙂

I’ve insured with 1 Cover several times and only have praise for them. I have had to extend my policy when my trip was extended and this was easy and a very low additional cost. I have made a claim for damage to a rental vehicle. My claim was paid as soon as I had submitted all the documentation from the rental car company. I can highly recommend them based on my experience.

You got a point here, that one should not be careless and just go totally uninsured.

I would dare to contradict however, that people really need a “full-blown” travel insurance. I do think one needs to keep apart “convenience” insurances for things one can really cover alone easily and those that might lead to financially catastrophic results. Which is mostly the

travel health insurance

as an ambulance flight is very costly and so is emergency treatment in some countries. So unless your home country provides already something comprehensive valid world-wide in their normal health insurance (not the case for most countries I know of!), you should check this out. It is also not expensive when you take a yearly police.

All else that can go wrong either has abysmal exclusions (baggage loss, cancellation policies) and / or can be dealt with for less than 1k EUR yourself. Unless you are an extreme high risk person in regard to this risk you will pay a higher premium than the risk is worth. After all the insurance company does want to make a profit.

So don’t ensure yourself against small money, but focus on the less-likely but catastrophic risks.

very helpful article , thanks a lot.