Did you know that the way the credit reporting system works in Australia has changed significantly in March 2014?

Since then, a new concept has been introduced to Australia, which has been at the core of the credit reporting system in many other countries (like the UK or the US) for many many years now.

It’s called: credit score.

Another major change that has occurred at the same time is what’s called comprehensive credit reporting.

The 2 minute video below gives the ‘gist’ of what “comprehensive credit reporting” actually means for consumers:

If you want to delve a bit deeper into the information and also make sure you are getting it from trustworthy & unbiased sources, I recommend you check the websites of the Australian Information Commissioner & the ASIC MoneySmart program.

You may think that all of this really does not concern you in any way as you don’t have any loans outstanding, don’t have a credit card and always pay for everything using cash or a debit card.

However, that would not be true!

Credit scores and the credit reporting system as a whole affect almost every single adult in Australia.

Do you have a postpaid phone plan account?

Do you have an internet connection or landline at home?

Do you use electricity or natural gas?

No doubt you’ll answer ‘yes’ to one or more of the questions above!

Well, guess what…

If you did, you have a credit file and a credit score.

The additional information which is now included in your credit file, and which is used to determine your credit score, has been collected since December 2012 but has only started being used in March 2014.

This information includes:

- The date your credit payments were due

- Whether or not you made the payments by the due date. It is important to note that no payment or even partial payment by the due date are both considered as missed payments.

- The dates which you made any missed payments (but not the amounts that were missed)

The criteria for recording defaults on your credit file have also been changed and are as follows:

- The default amount is $150 or more

- You’re a ‘confirmed missing debtor’ or ‘clearout’ which means that your creditor can’t get in contact with you, or

- 60 days or more have passed since the due date for payment and the creditor has asked you to pay the debt either in person (for example by phone call) or in writing (by sending a written notice to your last known address).

Your credit file now also includes information on any commercial or business loans you have applied for, regardless of whether you were approved or not for these loans.

Bottom line, it is crucial that you always pay your bills on time including your utility and telco bills.

If you are the forgetful type, I suggest you set up direct debits for all these accounts to avoid any issues.

The good news is that if you are diligent with your bills, your good behaviour is ‘rewarded’ as your good repayment history is now also included in your credit file and has a positive impact on your credit score.

Every Australian can obtain a copy of their credit report for free once a year.

If you have been denied credit (remember that a utility account is considered a credit product) within the last 3 months, you can obtain another copy for free even if it hasn’t been a year since you last requested one.

Australia currently has three credit reporting agencies. They are all commercial for-profit operators who have been licensed by the government to maintain credit files on all of us.

Each company maintains its own independent records so you will have to get a credit report from each of these three companies.

They are:

They all have a turn around time of around 10 business days for the free service or you can opt for the paid service and get your credit report either immediately or within a day.

If you now live, or have ever lived in Tasmania, you might also have a credit file with the Tasmanian Collection Service and will need to obtain a credit file from them as well.

What is a credit score and how does it impact me?

One of the most significant changes introduced under the new mandatory “comprehensive credit reporting” regime, which kicked in on July 1, 2018, is a personalised credit score for every adult in Australia.

This concept of credit scores existed overseas for quite some time now and in places like the US for example, it is so important and so pervasive that people ‘live and die’ by their credit score (including things like getting a job or being approved for a rental property).

This may sound a bit extreme but it really is the truth and Australia’s First Lady of Personal Finance thinks that it won’t be long before this is the reality facing us all here in Australia as well.

A credit score, in very simple terms, provides an assessment of how much of a potential risk you pose to credit providers by defaulting on your obligations if they were to enter into a credit contract with you.

How does a credit score rule your life?

The lower your credit score, the higher of a credit risk you are and as a result, the higher the chances lenders and other credit providers (such as telecommunication and utility companies) will not want to have anything to do with you or apply ‘sanctions’ before agreeing to take you on as a customer (e.g. require a security bond, require a higher upfront deposit or apply a higher interest rate) to compensate themselves for the higher risk they are taking upon themselves.

It is important to note that each credit reporting agency has its own scale and methodology for calculating a credit score.

This means that the actual numerical value of your credit score will be different with each of them.

Saying that however, the ‘gist’ of what that number means is the same as, in all cases, the aim of that number is to place you on a ‘creditworthiness scale’ for the benefit of finance providers (which includes utility companies and also Telcos who use it if you sign-up for any postpaid plan with them).

I really don’t want to confuse you any further by going into complicated finance jargon so instead suggest you watch the video below from a mortgage broker which explains quite well how the credit score is used in ‘real life’.

They start doing a bit of the ‘hard sell’ after the first minute so you are welcome to stop watching it after that 😉

If you want a detailed explanation of how the score is calculated and what factors are taken into account, I suggest you read this article from financial comparison site Finder which explains how Equifax, the biggest credit reporting company in Australia, is calculating their credit scores.

The process is quite similar for the other credit reporting companies as well.

Interesting findings from a recent research into Credit Scores in Australia

Comparison site finder.com.au have conducted a survey amongst more than 2000 Aussies to see what they know about the new credit score regime and how they are working with it.

Here is what they found:

Credit score sparks fear in a quarter of Aussies

- The majority of Australians (67%) don’t expect a lender to reject a loan or credit card application based on their credit score.

- However, 25% of Aussies fear they will get rejected for a loan or credit card because of their poor credit score.

Aussies have awesome credit: or at least they think they do!

- 71% of Aussies have no concerns about their credit score – rating it as either very good (21%) or excellent (50%).

- The survey of 2,033 Australians found:

- 3% rank their individual credit score as ‘bad’;

- A further 3% consider it ‘below average’; and

- When asked how they would rate their credit score, 14% said ‘good’.

- Slightly more women (10%) than men (7%) have no clue what their credit score is.

80% of Aussies haven’t made any attempts to improve their credit scores and 20% don’t even know how

- The majority of Aussies (82%) have never attempted to improve their credit score, and 20% of Australians don’t even know how.

- Of those that did try to improve their credit scores:

- 56% decided to increase savings to pay down debt;

- 27% consolidated their debt into a 0% balance transfer card; and

- 25% took out a new credit card to establish a credit history.

- Surprisingly, the demographic that was most likely to have done something about their credit score were Millennials, with 34% having made the move to improve their number. This is higher than Gen X at 17% and Baby Boomers, with only 10% having ever attempted to improve their credit scores.

How can I get my credit score?

First of all, you need to remember that each credit reporting agency has their own system for calculating credit scores and therefore, you will get a different number from each of them.

In order to get your credit score, you can:

- Order your credit report from each of these companies; and/or

- Get it through a dedicated online service.

The good news is that in both cases, it shouldn’t cost you a cent!

Dedicated online services for getting your credit score

If you want to get your credit score quickly & easily and either don’t want to wait for your full credit report to arrive in the mail or you’ve already used up your allowance of free credit reports for the year (one per person, per credit reporting company unless you have been denied credit within the last 3 months), you can use an online service for quickly retrieving your credit score directly from the credit reporting company.

Just to alleviate any concerns you may have: these services are almost always completely free (they make their money by other means as I’ll explain shortly) and using them won’t have any negative impact your credit score.

The credit scores from Equifax (formerly known as Veda) are the most widely used in Australia due to the fact that they have been down under the longest and therefore have the most comprehensive data on all of us (or so they claim).

This doesn’t mean however that their information is the most reliable or most up-to-date. They often make mistakes and then refuse to correct them, even when provided with the appropriate documentary proof.

Getting your Credit Score from Equifax (formerly known as Veda)

To the best of my knowledge, the only service which currently allows you to get your Equifax score for free is Get Credit Score.

Get Credit Score is a fully-owned subsidiary of Equifax themselves.

Here is how it works:

- You sign up for a free account on the website

- Your provide personal identity details

- Once they verify your identity, they will show you your Score with Equifax.

- The score will be updated every month in your account dashboard provided you log in at least once during the month.

Getting your Credit Score from illion (formerly Dun & Bradstreet)

Just like Equifax, Illion have been operating in Australia for quite some time now but you may know them under their previous name Dun & Bradstreet.

Their credit scores are widely used by Australian lenders but not as widely used as those from Equifax.

The best free service to obtain your Illion credit score (and keep ongoing tabs on it) is Credit Simple which are a fully-owned subsidiary of Illion themselves (just like Get Credit Score are owned by Equifax).

In order to get your score, you will need to supply them with personal information such as full name, date of birth, current and previous addresses plus details of an ID document (Drivers License or Passport).

They will use this information to verify your identity and give you your Dun & Bradstreet credit score.

Unlike the other credit score retrieval services, Credit Simple can be a ‘one stop shop’ when it comes to the information Dun & Bradstreet have about you.

This is because they also give you access to your full credit report with Illion through their dashboard. Not just your credit score.

Better yet, this access is ongoing and pretty much ‘real time’ so if Illion record any new information in the credit file they hold on you, you’ll be able to see it straight away (and free of charge).

Basically, if you use Credit Simple, you no longer need to request your Illion credit file separately.

Credit Simple also have this strange (or some would say ‘quirky’) thing where they compare your credit score anonymously against other people in your age group, your street and even your star sign.

Go figure! 🙂

Finally, if you check your score through Credit Simple and get a very low score (or even zero god forbid), they do a decent job at explaining why.

Getting your credit score from Experian

While Experian is a relative ‘newcomer’ to Australia, they are massive overseas and especially in the US where they are one of the biggest credit reporting companies (if not the biggest!).

Due to their relative short tenure down under, their credit scores are not as widely used at present.

However, it is still well worth your while keeping tabs on your personal credit score with them as well.

This is especially given the fact that unlike the Equifax Scores which you can only access every six months, Experian allows you to access your personal credit score once a month.

The best free service to keep tabs on your credit score with Experian is Credit Savvy which are owned by mortgage brokers Aussie Home Loans, themselves a subsidiary of the Commonwealth bank.

Here is a short promotional video from them explaining how the service works:

You’ll need to give Credit Savvy a valid email address as well as the details of your Australian drivers license, Passport (Australian or overseas) or Medicare card in order for them to verify your identity electronically and give you your credit score.

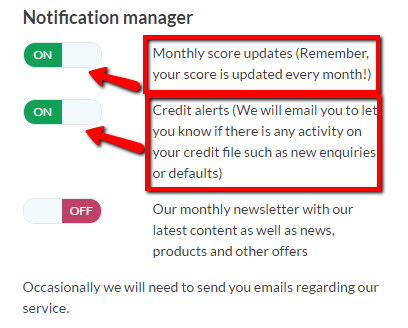

One thing I really like about Credit Savvy is the fact that they allow you to monitor changes to your credit score, and to your credit report as a whole, free of charge directly from your account settings.

This is something credit reporting companies usually charge you for.

For example, Equifax charges $60 a year for that.

As all these services are completely free to use for consumers , the obvious question arises:

How do these free credit score retrieval services make money?

Get Credit Score

As I said above, Get Credit Score is a wholly owned subsidiary of Equifax and it’s important that you understand that they are first and foremost, a marketing and lead generation arm for them.

This is actually the only reason why Equifax even have this service in the first place!

The following is a direct quote from their FAQ:

Do you keep my details?

Yes, it’s how we keep this service free. From time to time, we may use your information in marketing for Equifax and our partners, but no other third parties without your consent.

You can opt-out from our or our partner marketing at any time by contacting us and/or our partners.

Basically, if you have a good credit score, you can expect to quickly start receiving marketing offers from Equifax and whoever else they partnered with.

On the face of it, this may not sound very appealing but keep in mind that if your credit score is very good, you could potentially qualify for better interest rates than what’s on offer publicly to the general population..

However, if you are not in the market for a loan, you may not appreciate your data being used in this manner and if that’s the case, may prefer to stay away from Get Credit Score.

If on the other hand, your credit score is quite poor, I suspect that you may start getting offers from various companies offering to improve your score for a hefty fee.

This is purely a suspicion and I have no proof this is actually taking place but let’s just call it a calculated guess… 😉

Credit Simple

Credit Simple answer this question directly in their FAQs:

We work with banks, energy companies, insurance providers and telcos to get better deals for Australians.

We present offers based on your credit profile.

Each time someone signs up to a deal offered through this website, we get a small payment from the supplier. We also sometimes receive a fee to show an offer on our site.

We want to be transparent about how we make money, so you know how Credit Simple works.

They also have this to say about whether the commissions they receive will impact the offers they show you:

We’re not afraid to tell the banks, telcos or energy companies to do better and we work with them to get better deals for Australians.

We then match offers to our customers based on their credit scores and their credit profile.

While we don’t show or review all offers available in Australia, we believe all Aussies deserve better deals and we’ve designed Credit Simple to give you access to better financial deals and make more informed decisions.

We can’t guarantee that you will be approved for any advertised offer, and advertisers may take into account more than your credit score when assessing applications you make

My main concern with all these type of services is whether they pass private information they collect to any third parties and the statements above don’t really answer that.

Therefore I dug deeper into their privacy policy which had this to say in section 6 – Disclosure of your personal information:

You authorise us to disclose Personal Information to any of our Related Bodies Corporates for the purposes set out in clause 5. In addition, we may disclose Personal Information to:

Credit Reporting Body – if you request your credit score or other Credit Information using the Credit Simple Website – refer to clause 6.2 below;

Proviso – if you use Money Simple Services – refer to clause 6.3 below;

Clear Name– if you use Credit Simple to access your credit report – refer to clause 8 below;

Our service providers – such as identity verification service providers, Inspectlet (refer to clause 6.5 below), social media & IT suppliers/contractors, call centres, stationery printing houses, mail houses, storage facilities, lawyers, accountants and auditors, who need to have access to your Personal Information to provide their services to us;

Organisations that provide products or services used or marketed by us – including intermediaries, trustee companies, financial institutions and securitisers;

Other – (i) our employees or contractors to the extent reasonably necessary to fulfil our obligations to you; (ii) anyone considering acquiring an interest in our business or assets; (iii) other entities or persons to the extent reasonably necessary for the purposes set out in clause 6.2 or clause 6.3 above; (iv) any law enforcement, legal, government or regulatory agency, where such disclosure is required or authorised by law; and (v) other individuals or companies authorised by you.Advertisers and credit providers – You may choose to provide Personal Information directly to any advertiser (such as a credit provider), including as a result of using a link from the Credit Simple Website to an advertiser’s website. If you do so, the collection, use, storage and disclosure of that information by the relevant advertiser will be subject to the advertiser’s privacy policy. Any disclosures you make are subject to the advertiser’s privacy policy and terms and conditions.

You acknowledge that we do not control and are not responsible for any use of Personal Information by any third party that you disclosure, or authorise us to disclose, your Personal Information to.

Basically, if you allow Credit Simple to provide your information to any 3rd party, you better be sure who this 3rd party is and how they are going to handle your personal information.

It’s also worthwhile to make sure that the said 3rd party is an Australian entity and are keeping and handling your information solely on Australian soil.

If they don’t, you may not have the protections afforded by the Australian Privacy legislation.

Speaking of that, you may also want to draw your attention to section 9 in the Credit Simple privacy policy:

Sending information overseas:

9.1 We operate in both Australia and New Zealand so your Personal Information may be accessible in both countries to ensure we are able to provide our services to you.9.2 Personal Information that we collect is either held by us (at our offices in Australia and New Zealand) or on our behalf. Some information we hold may be stored in “the cloud” in databases on our behalf locally or overseas.

9.3 Please be aware that where your Personal Information is disclosed to a third party service provider, credit provider or other entity, they also may use cloud based processes located outside of Australia or New Zealand. We do not control where these service providers may allow Personal Information to be accessible including overseas.

This is pretty clear cut.

Credit Simple won’t pass your information to any 3rd party unless you specifically request and authorise them to do so.

However, some or all of these 3rd parties may store your information on servers and computer systems not located on Australian soil.

Therefore, it’s important you understand that once your personal information leaves Australia, it is anyone’s guess as to how secure (or not!) it may be and what protections you may have (if at all) in the case a data breach occurs.

Credit Savvy

Their FAQ says the following:

We’re committed to helping Australians make savvy financial decisions by helping them understand their credit status, completely and utterly for free. We don’t even ask you for your credit card details.

Our money comes from banks and other financial institutions. For example, they may pay us to show you their products. This enables us to give you your credit score and credit file information for free.

We will never sell your data because we respect your privacy and we value your trust. We won’t ever share your personal information with credit providers without your consent.

So, you will never be contacted by lenders or brokers as a result of using this service unless you explicitly request to be contacted.

As you can imagine, and for pretty obvious reasons, Credit Savvy ticks the ‘privacy box’ for me and I feel comfortable enough to use them myself.

Using the services mentioned in this post, you’ll be able to both find out and monitor your personal credit score without it impacting your credit score or costing you anything.

Just keep in mind that your credit score and credit report are two DIFFERENT things.

While Get Credit Score will give you your Equifax credit score, they will not give you access to your full Equifax credit report.

Instead, you will need to approach Equifax directly in order to obtain your full credit report.

The good news is that provided you meet these eligibility criteria, it won’t cost you a cent.

To get your Equifax credit report click here.

For questions or comments, the comment box below awaits. Don’t be shy! 🙂

According to the website, Finder are using Experian and not Equifax?

you’re right. Looks like they have switched to retrieving different scores.

Try using Get Credit Score instead for the Equifax score

Thank you for this. When I was making inquiries last year to borrow for an investment property, someone told me to be careful of making too many applications as it might affect my credit score. At that stage I hadn’t really considered the potential impact on my credit score, or even where I could find my credit score. This is really useful and informative.

I’ve been using credit savvy for 8 months and still no change on my score. I’ve paid off my CC and a small loan in the meantime yet this is not even recorded with credit savvy.

I’ve started using credit simple with D&B and wow! All the updated info is there with a higher score difference of 250.

Credit savvy is very delayed with updating info.

It’s not really credit savvy that is delayed. It’s Experian which is the credit reporting company that they retrieve their scores from.

Each one of the three national credit reporting companies (as well as the Tasmanian one) have their own scale and methodology for credit scores and are completely independent of one another.

Cheers 🙂

Cheers! ?

thanks guys, this is a great article and i appreciate the time and research that’s gone into it. i’ve joined credit savvy, and now know that paying my electricity bill a few days late actually matters! not letting that happen anymore!

this is brilliant – I’ve just signed up for Credit Savvy. I knew about the annual free report option but no idea we could get free monthly ongoing assessment.